Managing finances is crucial for small businesses. Having the right accounting software can make a big difference.

Small business owners need tools that simplify accounting tasks. The right software can help track expenses, generate invoices, and ensure tax compliance. Without it, managing finances can become overwhelming. This post explores the best software options for small business accounting.

These tools are designed to be user-friendly and efficient. They cater to the unique needs of small businesses, offering features that streamline financial management. Stay tuned to discover which accounting software could be the best fit for your business needs.

Credit: quickbooks.intuit.com

Key Features To Look For

Choosing the best software for small business accounting can be challenging. There are many options available, each with different features. To find the best fit, focus on key features. These features will help ensure the software meets your business needs.

User-friendly Interface

A user-friendly interface is essential. Your team should find the software easy to navigate. This reduces training time and errors. Look for clear menus and simple instructions. A clean design can make a big difference. Intuitive software can help keep your finances in order.

Integration Capabilities

Integration capabilities are important for small businesses. Your accounting software should connect with other tools you use. This includes payroll systems, invoicing, and CRM software. Integration saves time by automating data transfer. It also reduces the risk of errors. Check if the software supports popular apps you already use.

Scalability

Scalability is key for growing businesses. Your accounting software should grow with your business. Look for features that support more users and transactions. Ensure the software can handle increased data. This way, you won’t need to switch software later. Scalable software helps you plan for the future.

Quickbooks Online

One of the best choices for small business accounting is QuickBooks Online. This software offers a range of features, making bookkeeping simple and efficient. It’s popular among small business owners for its ease of use and comprehensive tools.

Features

QuickBooks Online provides many features tailored to small business needs:

- Invoicing: Create and send invoices quickly.

- Expense Tracking: Track expenses and categorize them.

- Bank Reconciliation: Sync with your bank to reconcile transactions.

- Financial Reporting: Generate profit and loss statements.

- Multi-User Access: Allow multiple users to access the account.

- Integration: Integrate with other business apps like PayPal.

Pricing

QuickBooks Online offers different pricing plans to suit various needs:

| Plan | Price per Month | Features |

|---|---|---|

| Simple Start | $25 | Basic features for one user. |

| Essentials | $50 | Includes bill management and up to three users. |

| Plus | $80 | Project tracking and up to five users. |

| Advanced | $180 | Advanced reporting and up to 25 users. |

Pros And Cons

QuickBooks Online has several advantages and a few drawbacks:

- Pros:

- Easy to use.

- Wide range of features.

- Good customer support.

- Cloud-based, accessible from anywhere.

- Cons:

- Monthly fees can be high.

- Advanced features cost extra.

- May be too complex for very small businesses.

Xero

Xero is a popular accounting software designed for small businesses. It offers an array of features to simplify accounting tasks. This cloud-based tool helps businesses manage their finances efficiently. Xero is known for its user-friendly interface and robust functionality.

Features

Xero boasts several features that make it stand out. It supports invoicing, expense tracking, and bank reconciliation. You can also manage inventory and payroll with ease. The software integrates with over 800 business apps. This ensures seamless workflow and data accuracy. Xero also offers real-time financial reporting. This helps businesses make informed decisions quickly. Another feature is multi-currency support, which is ideal for global businesses.

Pricing

Xero offers three pricing plans. The Starter plan costs $11 per month. It includes basic features like invoicing and bank reconciliation. The Standard plan is $32 per month. It adds payroll and inventory management. The Premium plan is priced at $62 per month. It offers advanced features like multi-currency support. Each plan comes with a 30-day free trial. This lets businesses explore the software before committing.

Pros And Cons

Pros:

- User-friendly interface

- Comprehensive feature set

- Strong app integration

- Real-time financial reporting

- Multi-currency support

Cons:

- Higher cost for advanced features

- Learning curve for new users

- Limited customer support hours

Freshbooks

FreshBooks is a popular choice for small business accounting. It offers a user-friendly interface and a range of features designed to help businesses manage their finances easily. FreshBooks is suitable for freelancers, small businesses, and service-based professionals.

Features

FreshBooks comes with a variety of features that simplify accounting tasks. Users can create and send professional invoices in minutes. The software also allows for easy expense tracking. You can snap a photo of a receipt and log it instantly. Time tracking is another useful feature. It helps businesses bill clients accurately for hours worked.

FreshBooks also supports project management. You can collaborate with team members and clients in one place. The software integrates with many popular apps. This includes PayPal, Stripe, and G Suite. FreshBooks also offers robust reporting tools. These tools provide insights into your business’s financial health.

Pricing

FreshBooks offers several pricing plans. The Lite plan starts at $15 per month. This plan includes invoicing, expense tracking, and time tracking. The Plus plan costs $25 per month. It adds features like project management and proposals. The Premium plan is $50 per month. This plan is ideal for larger teams and includes advanced reporting tools.

FreshBooks also offers a free trial. This allows users to test the software before committing to a plan.

Pros And Cons

FreshBooks has many advantages. The interface is user-friendly and intuitive. The software is easy to navigate. It offers a wide range of features. These features meet the needs of small businesses. FreshBooks also provides excellent customer support. Users can access help via phone, email, or live chat.

There are some drawbacks. The pricing may be high for very small businesses. Some users may find the features too advanced for their needs. FreshBooks also lacks some advanced accounting tools found in other software.

Overall, FreshBooks is a solid choice for small business accounting. Its features and ease of use make it a valuable tool for managing finances.

Zoho Books

Zoho Books is a top choice for small business accounting. It offers easy-to-use tools for managing finances efficiently. Ideal for tracking expenses and generating reports.

Zoho Books is a robust accounting software designed for small businesses. It offers a wide range of features that simplify financial management. It is user-friendly and highly efficient for small business owners.Features

Zoho Books provides a comprehensive set of features. It handles invoices, expenses, and inventory management. Automated workflows help save time. The software supports multi-currency transactions. It also integrates seamlessly with other Zoho apps. Real-time collaboration makes teamwork smoother. Financial reports are easy to generate and understand.Pricing

Zoho Books offers various pricing plans. The Free plan suits businesses with basic needs. The Standard plan costs $15 per month. The Professional plan is priced at $40 per month. The Premium plan is available for $60 per month. Each plan includes a 14-day free trial. Discounts apply for annual subscriptions. Zoho Books provides value for money.Pros And Cons

Zoho Books has several pros. It is easy to use and intuitive. Integrations with other tools enhance its functionality. Customer support is responsive and helpful. Automation features reduce manual work. There are some cons to consider. The free plan has limited features. Advanced features are only in higher-tier plans. Customization options could be more extensive. Some users find the learning curve steep.Wave Accounting

Wave Accounting is a popular choice for small businesses. It offers free accounting software with many features. This cloud-based solution is ideal for small business owners who need easy-to-use tools to manage their finances.

Features

Wave Accounting offers a range of features. These include invoicing, receipt scanning, and financial reporting. Users can track income and expenses. They can also manage their cash flow. The software integrates with bank accounts. This allows for automatic transaction updates. Additionally, Wave provides payroll services.

Pricing

Wave Accounting is free for its basic features. Users can access invoicing, accounting, and receipt scanning at no cost. For payroll services, there is a monthly fee. This fee varies by location. Payment processing also incurs a fee per transaction.

Pros And Cons

Wave Accounting has its advantages. It is free for basic use. The software is user-friendly and easy to set up. It provides comprehensive features for small businesses. Additionally, it integrates with bank accounts. This saves time on manual data entry.

There are also some drawbacks. The free version lacks advanced features. Customer support is limited. Some users may find the mobile app lacking in functionality. Payroll services are not available in all regions.

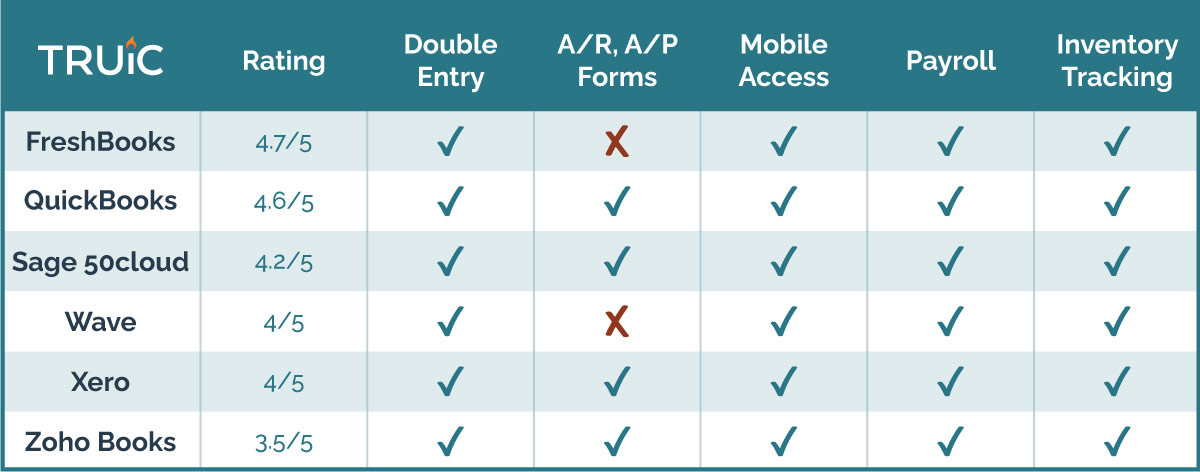

Comparing Top Picks

Choosing the best software for small business accounting can be challenging. With many options available, it’s crucial to compare the top picks. This section compares the top accounting software based on features, pricing, and specific needs. Let’s dive into the details.

Feature Comparison

Different software offers various features. Here’s a comparison of the key features:

| Feature | QuickBooks | FreshBooks | Wave |

|---|---|---|---|

| Invoicing | Yes | Yes | Yes |

| Expense Tracking | Yes | Yes | Yes |

| Payroll | Yes | No | No |

| Bank Reconciliation | Yes | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

Pricing Comparison

Costs are a major factor for small businesses. Here’s a pricing breakdown:

| Software | Basic Plan | Premium Plan |

|---|---|---|

| QuickBooks | $25/month | $150/month |

| FreshBooks | $15/month | $50/month |

| Wave | Free | N/A |

Best For Specific Needs

Every business has unique needs. Here are the top picks for specific requirements:

- QuickBooks: Best for businesses needing payroll and advanced features.

- FreshBooks: Ideal for freelancers and service-based businesses.

- Wave: Perfect for very small businesses and startups on a budget.

Credit: www.pcmag.com

Credit: howtostartanllc.com

Frequently Asked Questions

What Is The Best Accounting Software For Small Businesses?

The best accounting software for small businesses varies. Popular options include QuickBooks, Xero, and FreshBooks. Each offers unique features, like invoicing, expense tracking, and reporting.

How Much Does Small Business Accounting Software Cost?

Costs for small business accounting software range from $10 to $50 per month. Some providers offer free trials. Pricing depends on features and user count.

Can Accounting Software Integrate With Other Tools?

Yes, most accounting software can integrate with other tools. Common integrations include payroll services, CRM systems, and payment processors. This streamlines operations.

Is Quickbooks Good For Small Businesses?

Yes, QuickBooks is highly recommended for small businesses. It offers comprehensive features like invoicing, expense tracking, and financial reporting. Many users find it user-friendly.

Conclusion

Choosing the right accounting software boosts small business efficiency. The options listed are reliable and user-friendly. Each offers unique features to fit different needs. Evaluate your business requirements and budget. Then, pick the best software for you. A good choice simplifies financial management and saves time.

Stay organized, reduce errors, and focus on growth. Happy accounting!